FINANCIAL SUPPLY CHAIN AND DIGITAL BANKING SOLUTION

Accelerate Financial Processes Across Supply Chain

Partner with us to offer your clients cutting-edge financial supply chain solutions that streamline processes, improve working capital, and boost business agility

ABOUT

Optimize Working Capital with Innovative Supply Chain Financing Solutions

Digicorp Financial’s Supply Chain Solution is an integrated platform that helps banks optimize their customer’s working capital and funding while managing risks involved in delivering between business structures, processes, financing schemes, and payment channels. Digicorp FSCM has been in the market for over 15 years and has proven its effectiveness. By adopting Digicorp FSCM, banks can get a head start by delivering market-best solutions.

Digicorp Financial’s Supply Chain Solution is an integrated platform that helps banks optimize their customer’s working capital and funding while managing risks involved in delivering between business structures, processes, financing schemes, and payment channels. Digicorp FSCM has been in the market for over 15 years and has proven its effectiveness. By adopting Digicorp FSCM, banks can get a head start by delivering market-best solutions.

FLOW

Process Overview

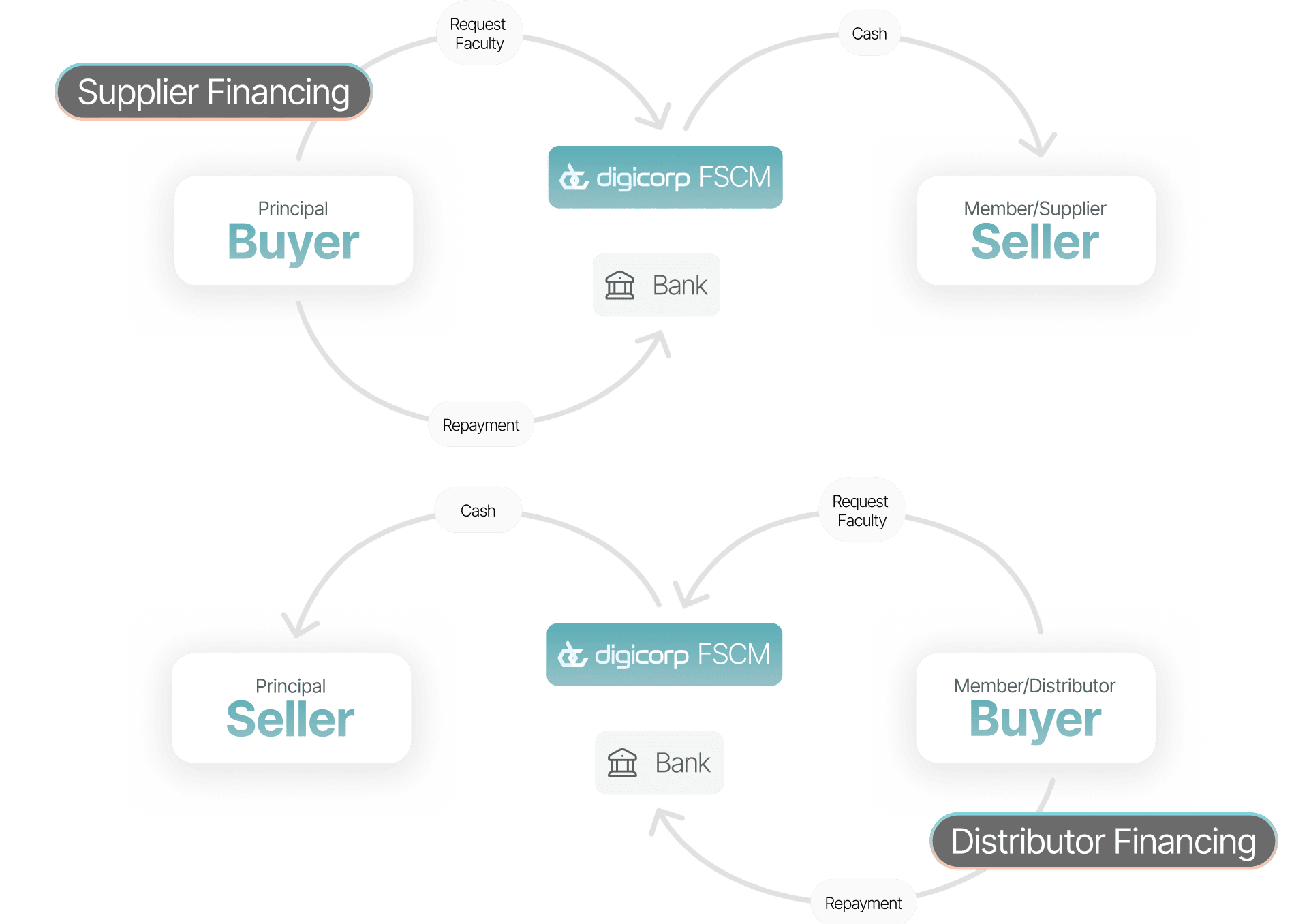

Supplier Financing

Supplier Financing enables suppliers to receive prompt payment for their invoices, with the buyer (typically a large corporation) serving as the anchor. In this arrangement, the bank facilitates early payment to the supplier, while the buyer settles the payment with the bank at a later date. This process enhances the cash flow for suppliers and fortifies the resilience of supply chains.

*The workflow can be adjusted to suit the supplier’s needs

*The workflow can be adjusted to suit the supplier’s needs

Distributor Financing

Distributor financing enables buyers, specifically distributors, to secure funds for purchasing goods from a principal seller. The process is initiated by the seller, with the bank supplying the necessary capital, which the buyer then repays over time. This arrangement fosters sales growth and ensures a stable distribution network.

KEY DIFFERENTIATORS

Strategic Value Proposition

Industry-Specific Template

Provides industry-specific templates to classify customers according to their respective industry sectors.

- Business Community: Acts as a bridge between the principal and its members.

- FSC Scheme: Offers tailored financing schemes.

- Customizable Workflow: Can be adjusted to align with each bank’s unique needs and business processes.

Parameterization & Automation

Delivers high flexibility through customizable settings based on the bank’s requirements.

- Predefined templates enable faster time-to-market.

- Minimizes the need for major changes or further development.

Dynamic Facility & Interest Model

Enables flexible configuration of credit limits and interest rates per customer transaction.

- Dynamic Interest Model: Adjusts according to financial conditions.

- Overdraft Facility Account: Accounts can operate with negative balances.

- Revolving Loan Account: Credit limits are restored upon repayment.

Open to Potential Market

Supports market expansion through open and flexible schemes.

- Non-onboard Members: Allows bilateral schemes directly between principal and bank.

- Industry Size Monitoring: Provides insights into industry trends and market size.

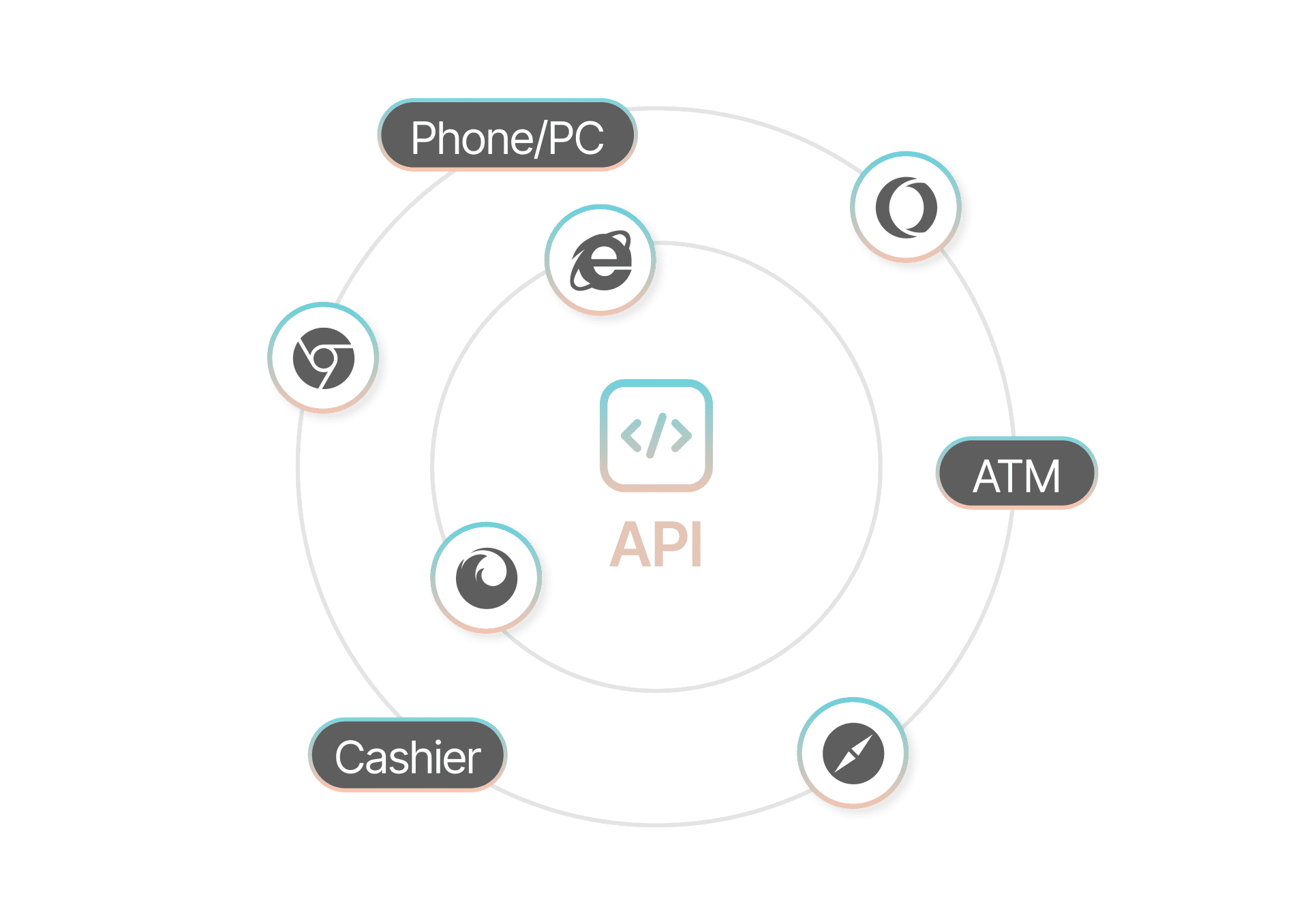

Integration via SSO & API

Facilitates system integration via Single Sign-On (SSO) and API connectivity for:

- Trade Finance

- Cash Management

- Principal’s ERP

- Omni Payment Channels

Recognition: The ASIAN Banker Award

Recognized by leading ASIAN financial institutions:

- RHB Malaysia

- Maybank Indonesia

![]()

FACILITY INTEREST

Offer Flexible Rates for Extended Loan Terms

Get full transparency over your financing cost—from the maturity date to the end of the penalty period. Understand how dynamic rates, admin fees, and increasing interest are applied per disbursement, empowering better repayment planning.

FEATURES

Explore Our Key Features

We’ve built these features to solve real-world problems faced by banks and enterprises, enhancing workflow automation, managing disbursements, and simplifying financial collaboration at scale.

FSCM Studio

Allows banks to operate effectively with the platform. The FSCM engine can operate by this module, through parameterized configuration. The bank can isolate, monitor and mitigate the modules in one platform.

Transaction Workflow

In order to give authorization to release funds, there has to be an agreement between the seller, buyer, and the bank. Some processes may authorize the principle to release funds after authentic approvals are done. This module provides flexibility in order to authorize the transaction.

Payment and Disbursement

Funds are disbursed instantly, on schedule, or upon trigger events like goods receipt. Risk-sharing affects the financed invoice percentage and involves managing cash flow, terms, tenure, penalties, and risk.

Multiparty Document Management

Enabling community interactions between sellers and buyers. Document approval exchange is very important to avoid dispute before proceeding to financing or payment. This process can be customized based on the communities business processes.

Loan Report

Provides a financial overview, which is very important in ther matter of principles, to see the customer’s power of purchase, or sometimes the liquidity risk. The Corporation can also access their loan exposure, due date, and status.

Settlement Management

Upon settlement, banks update FSCM with loan status, which affects risk and buying power. New purchases may be restricted based on status, and early settlement policies are supported.

Authentication and Security

Security is the number one concern in the banking industry. This module manages role and responsibility, privilege, information storage sensitivity, two factors authentication, single sign-ons, CIF and account access, etc.

Connectivity

SGO FSCM is an “open” system that is very flexible and can be integrated to various systems within the bank. It uses industry API standards that allow to connect to the surrounding bank host environment. SGO FSCM also have Open-API to connect external systems with different levels of security procedures.

Loan Engine

Calculates loan of-balance-sheet (outside core banking), and submit the value to core-banking, to reduce workload of core system.

CORE CAPABILITIES

FSCM and Electronic Invoice Presentment & Payment (EIPP) solutions.

Digicorp FSCM empowers companies with a secure, automated, and collaborative invoicing solution through EIPP (Electronic Invoice Presentment & Payment). Built to support complex supplier-buyer-bank interactions, the platform streamlines end-to-end transaction flows, from Purchase Orders to Delivery Notes, Goods Receipts, and Invoice Payments.

FLEXIBILITY

Customer Onboarding

Implementing Financial Supply Chain solutions isn’t a one-size-fits-all approach. Each customer, business process, and scheme is unique, making predefined products inefficient and costly. Instead, banks must start by understanding customer needs and mapping real-world processes into system parameters (pull-product)

Digicorp FSCM simplifies this by identifying key factors such as business structure, disbursement triggers, required approvals, and financing scheme rules. It helps evaluate risks, set financing limits, determine capital contribution needs, and manage transaction eligibility.

ECOSYSTEM

DigiCorp FSCM Ecosystem

This solution is designed with flexibility at its core, adapting to varying business processes, customer types, and financing models. It enables banks to configure tailored schemes that align with real-world operations across different communities and industries.

Business Structure

Define the roles of sellers and buyers, identifying the anchor and member within the community.

Business Structure

Define the roles of sellers and buyers, identifying the anchor and member within the community.

Supply Chain Finance Schemes

Establish financing schemes within the community, covering rates, fees, penalties, and risk mitigation measures.

Payment Channel

Account for customer segmentation based on technology and behavior, enabling access to various financial channels. This includes the ability to collect payments from multiple banks and financial institutions.

Business Processes

Map out existing business processes, such as Purchase Orders, Goods Receipts, and Invoices. This includes determining which party issues and approves documents, payment terms, and any risk mitigation, like holding limits.