e-Bank Guarantee

Streamline Secure Bank Guarantee Ecosystem.

e-Bank Guarantee Purposes:

- Eliminate the hassle of applying for a Bank Guarantee, such as sending documents, storing documents, and so on

- Simplify storage organization

- Issuance of e-Bank Guarantee in the form of a secure file that cannot be changed (temper evidence).

- e-Bank Guarantee can also be verified electronically so that it can be compared with the original data online.

- The process is completely electronic starting from the application, document collection, verification, approval, insurance, to issuance.

- Provide cross-selling opportunities for opening new accounts.

- Provide “marketing” opportunities with fee-sharing provisions for special obligees.

- Realtime notifications will provide information about related parties regarding Bank Guarantee that have been issued or waiting for approval.

- Facilitate the registration and onboarding of bank guarantee applicants through the partner portal

Collaboration

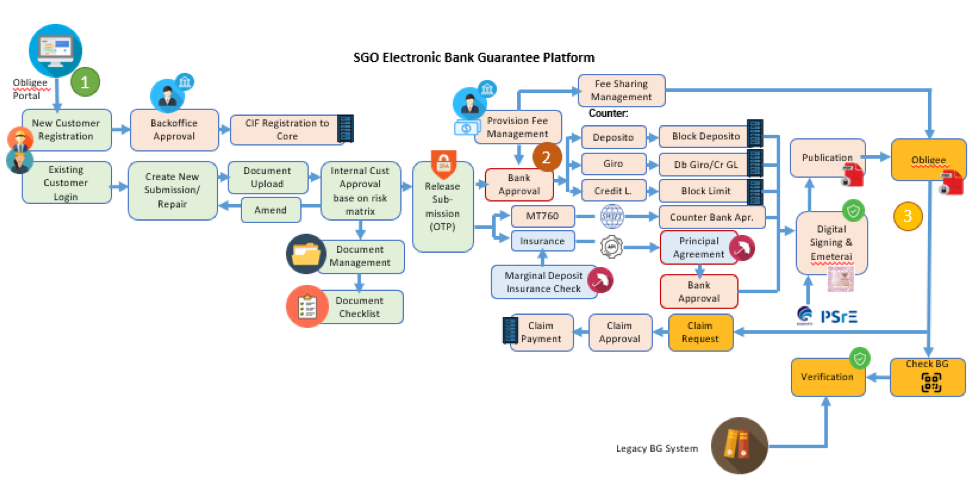

SGO e-Bank Guarantee collaborates with various stakeholders ranging from obligees, insurance, and customer banks to streamline a secure bank guarantee ecosystem.

Facilitated with a host-to-host API to your procurement system to facilitate the procurement of goods/services at a mutually agreed time and also to ensure security by using an electronic signature and electronic stamp.

Feature

Workflow