Digital Banking for Corporate

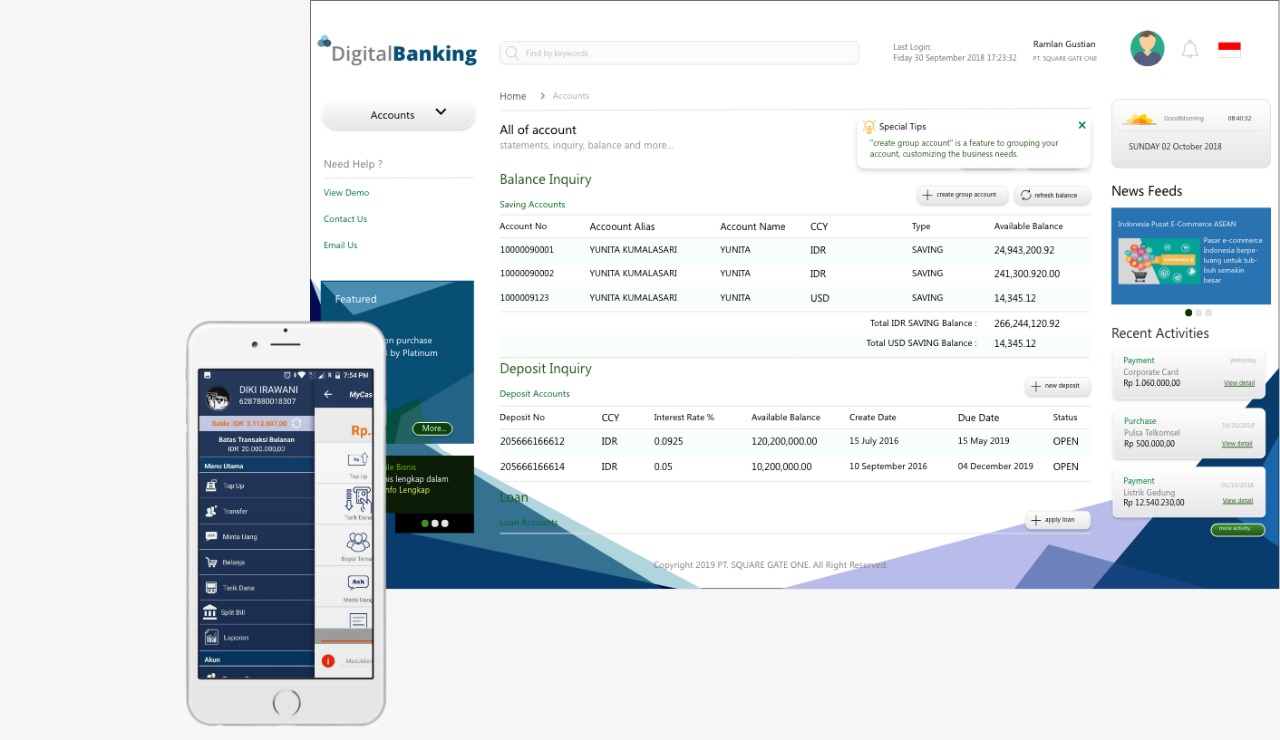

Extend corporate banking services to a web-based electronic channel. Allowing banks to operate cost effectively, improving corporate customer banking access, monitoring liquidity, and gaining real-time financial control. Improving corporate fund collection and distribution. Reducing human error by auto-reconciliation and notification.

Account management

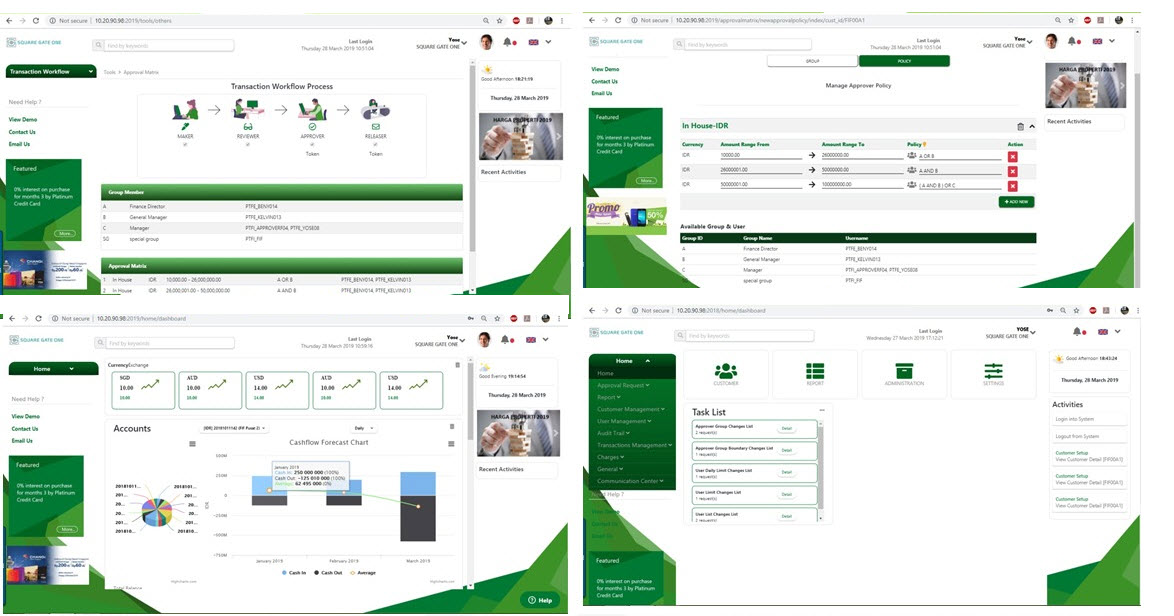

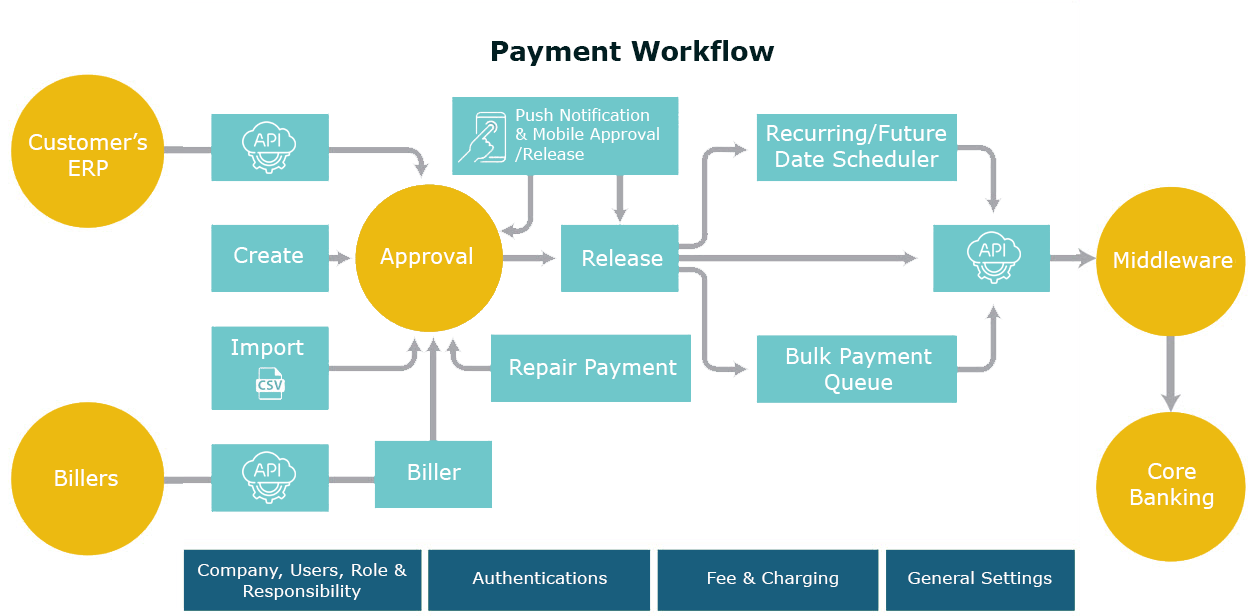

Push Notification & Mobile Approval/ Releaser

Multiplatform authentication (mobile token, sms & hard token)

Ready-to-use bill payment, voucher purchase, tax payment MPN G2

Online account opening for additional savings, deposits, loan drawdown

Banking services, trade, & inquiries such as check book, loan, LC/BG opening with balance locking, etc

Bulk & multi transfer for many currencies, or from many sources, account sweeping & remaining balance control

Online customer support & ticketing

Account statements & debit/credit notification

Fund transfer schedule management for future execution, recurring

Open API: secure Application Programming Interface for ERP integration

Notification in format such as email, SMS, Application Programming Interface (API)

E-commerce & payment gateway services, virtual account, bill presentation, and reconciliation

Fund transfers between accounts, domestic banks using EFT/RENTAS/IBG/SKN/RTGS/ ATM. Switching, remittance, local remittance, cross currency/forex with counter rate or dealing rate, virtual accounts, loan accounts

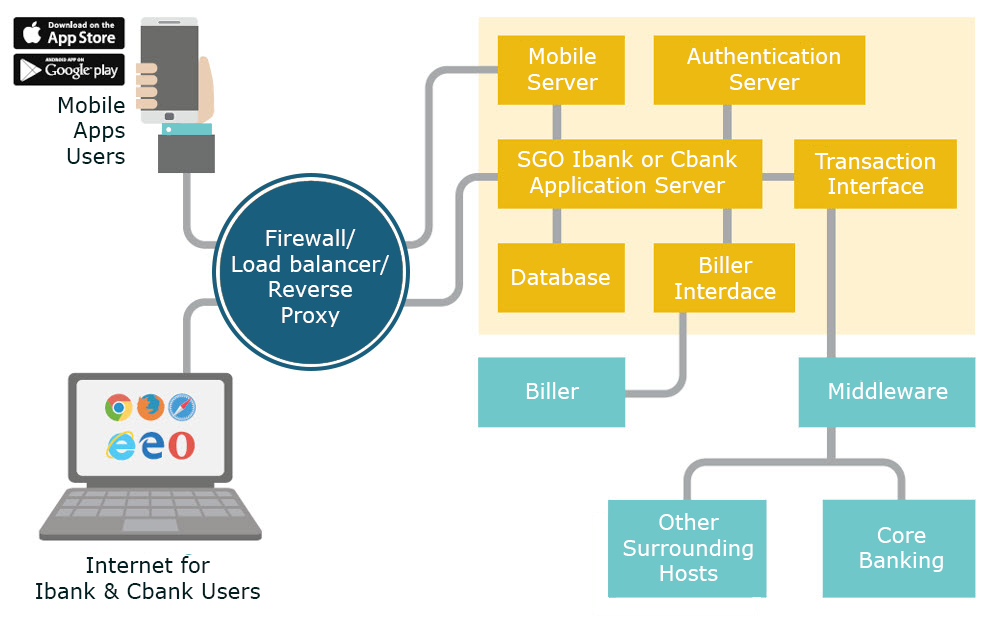

Topology