Virtual Account and Online Collection System

Improving business & corporate collection process.

Accepting funds transfer online realtime via banking channels that are available in the market (less friction)

Automatic Transaction identification and reconciliation to reduce human error and increase speed performance (reduce cost)

Improve Customer’s Delivery Performance (increase revenue)

- Improving business & corporate collection processes.

- Integration to core banking, connecting to “on us” banking channels such as tellers and other e-channels, “off us” banking channels via interbank switching such as ATM Bersama, Prima, Alto, MEPS.

- Managing Bank Identification Number (BIN) & beneficiary accounts.

- Fee Management for fee-based revenue and fee sharing model.

- Customer portal for invoice management, upload/download, partial or full payment, account receivables & credit notes, reconciliation, payment reports.

- Application Programming Interface (API) for billing information and real-time payment reports to customer’s ERP.

- Fund acceptance restriction, for example accepting funds for only certain amounts, less than or greater than specified amount. (Open/ close billing)

- Reversal & error correction management.

- Generating dynamic or static VA for recurring payments or one-time payments.

- Module can be integrated to cash management system

- Payment process can be integrated to payment gateway for e-commerce payment.

- Corporate white label invoice system.

- Suitable for several industries: education & services, financial services, airline & travel, e-commerce & retail, memberships, etc.

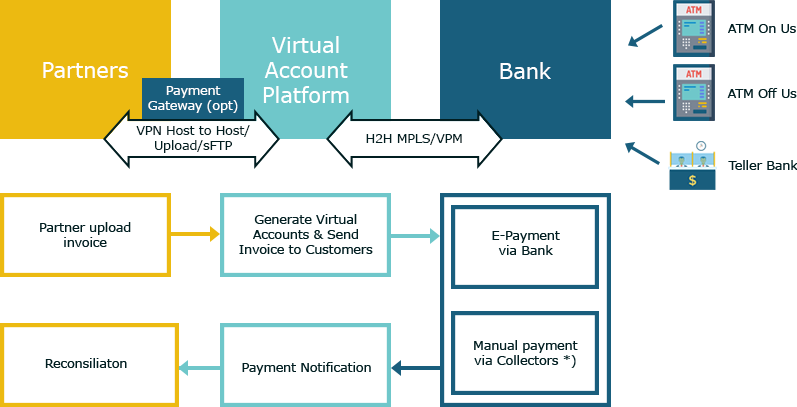

Business Flow

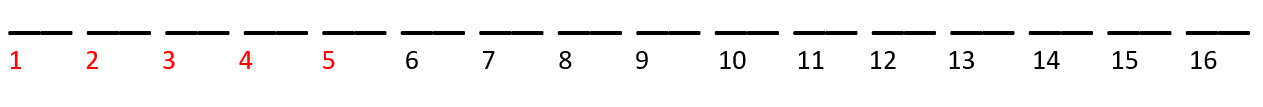

Case of Managing 16 digits Virtual Accounts

How to organize 16 digits VA:

- 1 – 5 : managed by bank by core banking, representing VA account type and partners/institutions, also mapped to beneficiary account.

- 6 – 16 : managed by partners/institutions and by Virtual Account Portal, to identify customer numbers, invoice numbers, member numbers, account numbers etc.

Example:

- 70010 8161899241

- 7 represents account type of VA

- 0010 represents an institution and a specific beneficiary.

- 8161899241 represents a member number of an institution.

Using ATM off us, basic information will be presented as:

Account Name : Deddy (Kls 3 SD)

Account Number : 7850000124123412

By using ATM on us, some additional information can be presented as:

Institution Name : SGO

Reference Number : BIIVA-700844-6ECF5FA

Amount of bill : Rp. 200.000,00 (fixed can not be changed)

SGO Virtual Account Portal has advanced features to help the institution manage their bills for the customer. Some of the features are:

Open amount

In this case the system will not reject any amount of transaction, like for example installments. Any amount can be paid into the Virtual Account.

Closed amount

Amount must be entered exactly as billed (in on-us ATM, amount can not be altered), otherwise the system will reject the transaction.

Notification

When uploading the invoice system it can generate invoice notifications to SMS or email, while the institution provides the email or handphone number.

Auto archive

While housekeeping is performed, the system can do auto archiving and create a new balance for every debit or credit note that remains open.

Credit Note and Debit Note

Keeps track on all the payment transactions to the Virtual Account. Every VA generated will have a “mini ledger” that shows debit-credit and remaining balance due.

Auto Reconsiliation

Every payment will be reconsiled to the uploaded invoice. All invoices that have already been paid can be automatically set to close (can not be paid anymore, to avoid double payments).

And many more such as reporting, invoice engine, etc.

Online Collection

The Online Colection module is the extended module of the Virtual account that handles manual hard-cash collections by collector agents. Collector agents are the ones who are assigned by institutions to physically collect the funds. Online collection module systems can help the institution to:

Track the invoice collection by geographical location.

Non-dispute transaction between customer collectors = institutions.

Collector’s AR status monitoring to keep track on how much cash-in-hand the collector has, and how much is already deposited.

Bill Payment

Collection status monitoring to check whether the collector has already performed the collection or not.

Manual payment via collectors: